The ESG for Investors platform provides investors with tools to better help them maximise the impact and risk-adjusted returns,

including an ‘engagement maximiser’ to identify the most material ESG factors

that, if addressed, could make a positive impact on a company’s share price. In

this post, we look more closely at the factor that this research has found to

have the highest upside across all sectors – addressing CO2

emissions.

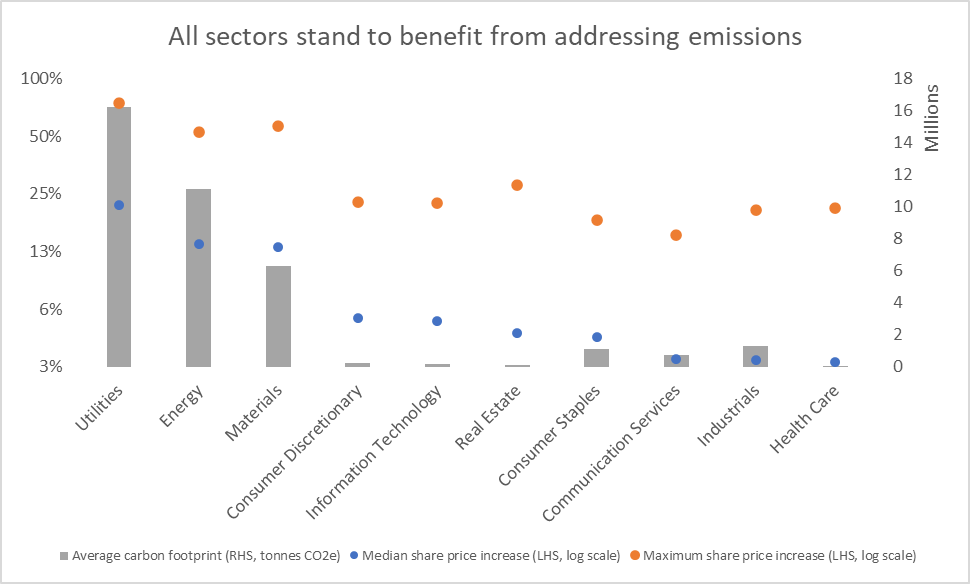

The chart below shows the median (in blue) and maximum (in orange) potential share price appreciation if companies within each GICS sector were to bring their emissions performance in line with their peers in the top decile.

Source: ESG

for Investors, S&P Trucost, Fulcrum Asset Management LLP. As of November 2021.

What does this

mean for investors? We identify three main implications.

1. Reducing emissions can pay

off

Company action

on climate is often presented as an insurance policy – if and when

policy-makers introduce a global carbon price, companies may face

significantly higher costs, which early action can reduce or avoid. This framing

can be misleading, by placing the emphasis on a single future event

(which may or may not happen). But the reality on the ground, today, is already

more nuanced.

First, whilst

short of a single, planetary price, the reach of carbon pricing is growing

(currently covering 21%

of global GHG emissions), as are the linkages between the various sub-,

supra- and national pricing initiatives, and the price levels (with the EU

carbon price offering the most dramatic illustration).

Second, as the chart illustrates, carbon re-rating is not a speculative scenario, but is already happening: this research suggests that companies which are the top-performers in terms of addressing their emissions are rewarded by the market with higher multiples. The median potential share price increase was at least 3% across all sectors[1]. This result reinforces our belief that climate change represents a first-order investment issue, with risks and opportunities facing all sectors.

2. Largest emitting sectors

have the largest gap between leaders and laggards

Emission reduction matters to all sectors, but not in the same way. The sectors whose business model is most directly linked to extracting or burning fossil fuels (utilities, energy and materials) show the highest median potential upside from reducing emissions (22%, 14%, and 13%, respectively). This makes intuitive sense, as the largest emitters also have the highest room to reduce emissions. However, more interestingly, this means that investors can benefit from using their capital to lead to immediate emission reductions within these sectors, given the high divergence between the leaders and laggards.

3. There is room for improvement across all sectors

Another

important insight of the research is the need to look beyond the ‘usual

suspects’ such as fossil fuel companies. Consumer discretionary, IT and real

estate companies, on average, face a potential upside of 5% by addressing their

emissions – with opportunities available across all sectors. Climate change is

an issue that can only be solved if all sectors do their part.

Admittedly, the

narrower gap between the median and the maximum uplift suggests there are fewer

low-hanging fruit in lower-emissions sectors, but this should not be an excuse

for complacency. Indeed, the growing discussions of the carbon footprint of

everything from burgers to cryptocurrencies, points to increased public and

regulatory ESG scrutiny that is spreading beyond the ‘usual suspects’ – and

also to increased consumer demand

for more sustainable goods and products.

In summary

More broadly, we

believe these results provide a positive incentive for action across all GICS sectors

– one of the reasons why Fulcrum supports CDP’s campaign

calling on over 1600 large companies to set Science-Based Targets, and why we

are encouraging companies to set science-based emission reduction targets.

The time to tackle emissions is now, helping companies and investors unlock value without locking in an unsustainable future for the planet.

[1] with the exception of financials, who are not included in the

analysis